#1 AI Meeting Assistant for Insurance Producers, Advisors, and Distributors

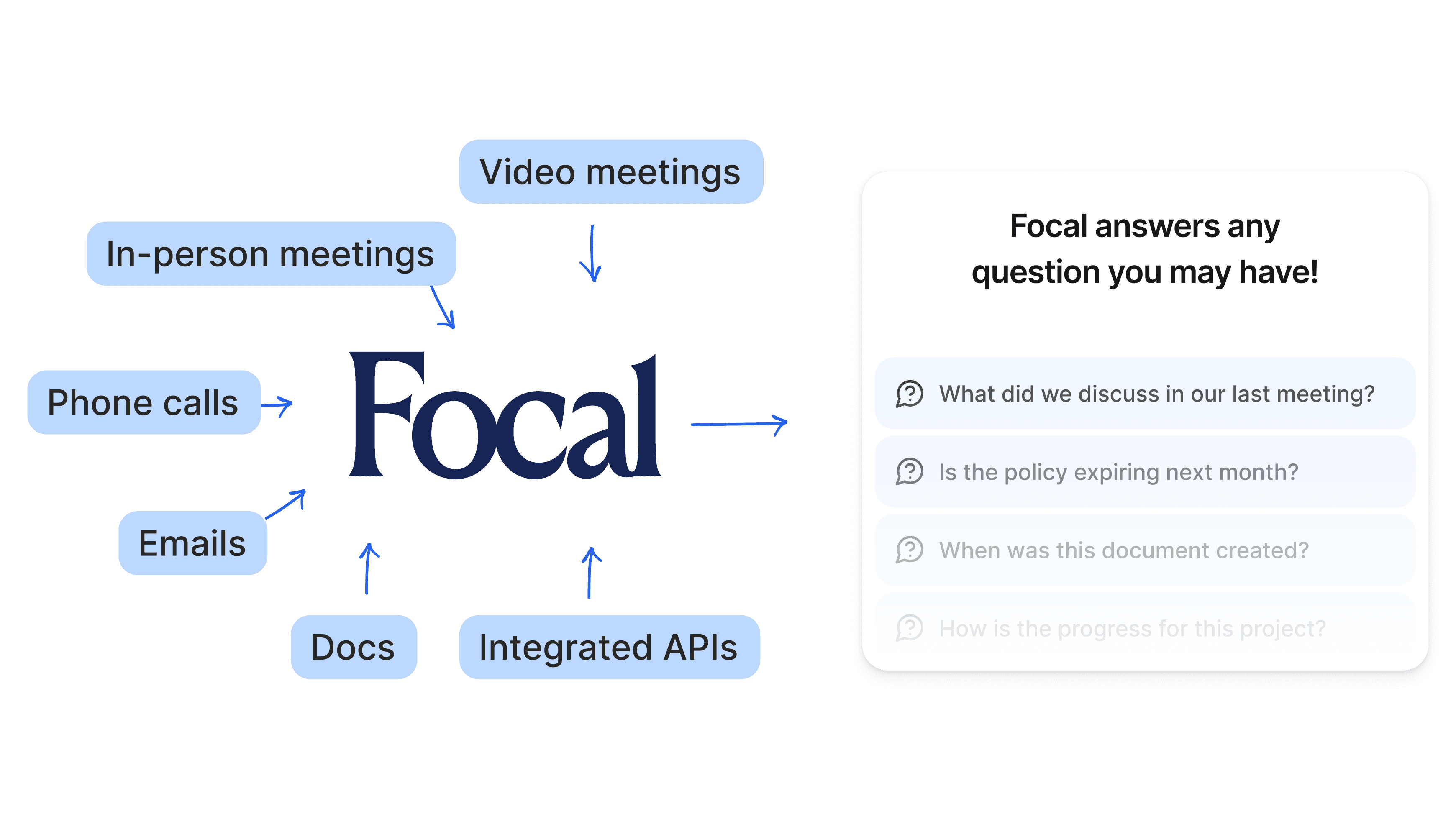

Focal is the AI overlay for insurance that gets producers, CSRs, and wholesalers submission-ready—faster and with fewer errors. Automate the entire meeting workflow: capture complete notes, extract structured data fields, complete intake forms, auto-fill applications, draft client emails, and sync everything into your AMS and CRM. SOC 2 Type 2 certified.

Hours saved

10+ hours saved

per week.

AMS integration

12 AMS & CRM

integrations supported.

For Insurance

100% designed for

insurance services.

Focal integration ecosystem

Integrate seamlessly across tools to automate data and actions — or use our API for custom workflows.

Solutions

Without Focal

Missed tasks = lost commission.

Agents lose money when tasks slip, deadlines are missed, or follow-ups aren’t completed quickly enough. One missed step can kill a case.

Without Focal

Incomplete fact-finding derails applications.

Missing beneficiary data, suitability answers, or financial details forces agents to chase clients again — slowing the process and breaking urgency.

Without Focal

Admin work steals time from selling.

Manual notes, writing emails, updating the AMS/CRM, and re-entering data burns hours that should be spent selling — not typing.

Without Focal

Clients delay cases with missing info.

Missing signatures, forgotten documents, or incomplete forms cause multi-day delays and burn your production time.

Without Focal

Too many systems slow you down.

Agents bounce between AMS, CRM, email, quoting tools, and carrier portals — none of which talk to each other — slowing everything down.

Without Focal

New agents take too long to ramp.

New producers struggle with process, documentation, and suitability, requiring constant oversight that drags down leaders and slows production.

Without Focal

Quoting and case design are slow and inconsistent.

Wholesalers can’t build illustrations or quotes when agents send partial data. Missing info stalls case design and reduces placement.

Without Focal

Field underwriting lacks data to assess risk.

Underwriters spend hours chasing medical, financial, and suitability info before they can review a case.

Without Focal

Enforced services work drains support teams.

Requests like allocation changes, beneficiary updates, address changes, and RMD coordination require manual checks and documentation that consume staff time.

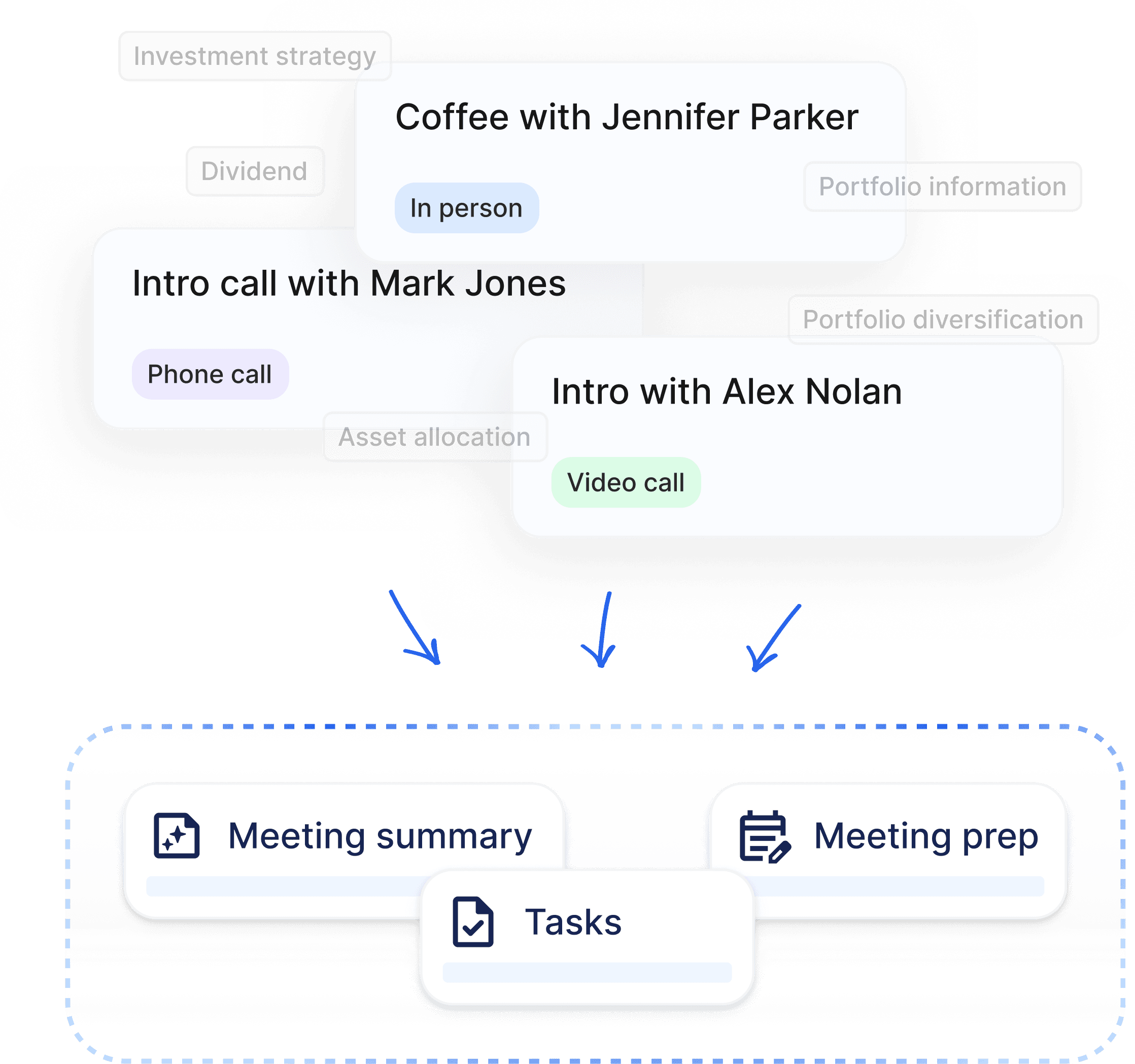

Whether you're on a phone call, in a Zoom meeting, or sitting with a client, Focal captures everything—accurate notes, compliance-ready summaries, next steps, and suitability details.

Invite Focal once and let it handle the documentation while you focus entirely on the client.

Clean, compliant meeting summaries

Auto-generated next steps + tasks

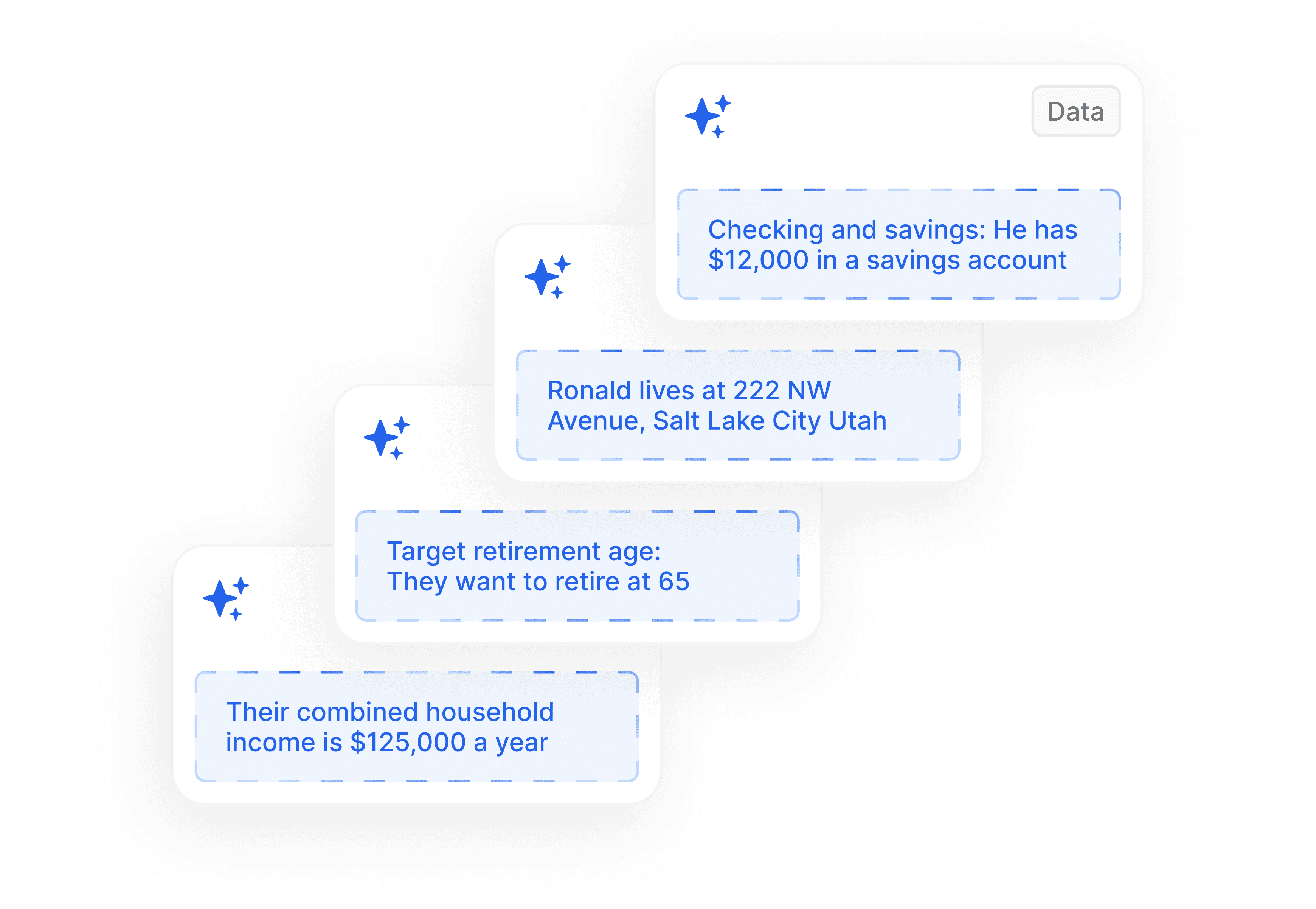

Focal auto-fills insurance applications using client data from past meetings, your CRM, emails, and your calendar. No more double-entry, copy-paste, or chasing missing details.

Auto-sync client data across AMS, CRM, and PAS

Pre-fill forms to request quotes / submit applications

Focal creates personalized email templates for agents to edit and send for every type of client interaction.

With real-time intelligent search across all meetings, notes, and integrated systems, Focal surfaces the right information instantly.

“What did we discuss in our last meeting?”

“Is the policy expiring next month?”

#1 in Security

SOC 2 Type 2

Focal is SOC 2 Type 2 compliant, with active monitoring through Vanta.

End-to-End Encryption

AES-256 and TLS 1.2+ data encryption at rest and in transit.

The Most Secure Cloud

Uniquely built on Microsoft Azure, the most secure cloud for financial services.

Enterprise Data Retention Requirements

Stateless AI models do not require transcripts to generate summaries.